Building and Development

| Minimum Requirements for Development in the SFHA | Higher Regulatory Standards used in some Louisiana communities |

|---|---|

| All development in the SFHA requires a permit."Development" includes building, stock-piling and contouring the land. | Buildings outside the SFHA are regulated to protect them from flood damage. Flood zones NOT in the SFHA are X (C on older FIRMs), X-protected by levee, 0.2% annual change (B on older FIRMs), and D. |

|

New residential buildings in the SFHA must have their

lowest floor at or above the BFE.

|

Freeboard: Lowest floor must be higher than BFE.

Common values are 12 or 18 inches higher than BFE. The Louisiana Residential Building Code, which is based on the 2012 International Residential Building Code, sets some requirements for building in the SFHA that exceed the federal minimums. See IRC Chapter 3 Section R322 |

|

Non-residential buildings in the SFHA can meet the flood protection

requirement by dry-floodproofing (sealing the building to keep floodwater

out) instead of elevating to the BFE. FEMA P-936 Floodproofing Non-Residential Buildings (2013) provides guidance. |

|

|

Agriculture buildings (for example grain bins and barns) can obtain a variance

to allow them to build with the lowest floor below BFE if they wet

floodproof the structure. While this is not considered an ordinance violation, the

building will not get credit for the wet floodproofing when purchasing flood

insurance from the NFIP. Technical Bulletin 7-93, Wet Floodproofing Requirements provides guidance. |

|

|

Buildings in A zones may

achieve the elevation requirement by being supported on compacted fill (mound

of dirt). Buildings in V zones may not be supported on fill. Their foundations must be free of obstructions of flowing water. |

Compensatory Storage

: The community requires that flood storage

capacity removed placing fill material in the SFHA must be compensated by creating storage capacity elsewhere in the SFHA. Limited Fill in the SFHA: The community restricts the amount of fill that can be placed under a structure. For example, fill may limited to two feet deep and be used only under the building footprint. |

| Substantially damaged buildings in the SFHA must be elevated so the lowest floor is at or above BFE before they can be repaired. Substantial Damage means the cost to restore the building to its pre-damaged condition is 50% or more of the market value of the building prior to being damaged. This rule applies regardless of the cause of the damage (flood, tornado, house fire). |

Lower Substantial Damage Threshold

: The elevation requirement is

triggered when the cost to restore is less than 50% of the pre-damage market

value. Values of 25% to 40% have been used in Louisiana. Cumulative Substantial Damage: The community enforces the substantial damage rule when the substantial damage threshold is crossed in the second or third event. For example, damage in the first event is 35%, and 25% in a second event. The sum is greater than 50%, so the second event triggers the rule. |

| Buildings being substantially remodeled, renovated or improved in the SFHA must be elevated so the lowest floor is at or above BFE. For lateral additions in the A zones, only the addition must meet the elevation requirement. In V zones, the entire structure must be elevated. As with substantial damage, the threshold for "substantial" is 50% of the market value before improvements are made. |

Lower Substantial Improvement Threshold:

The elevation requirement is

triggered when the cost to restore is less than 50% of the pre-damage market

value.

Cumulative Substantial Improvement : The community enforces the elevation requirement when the substantial damage threshold is crossed in a second or third improvement. For example, the initial remodel is valued at 35% of the market value, and the owner obtains a permit to undertake another improvement valued at 25% of the market value. The second improvement pushes the improvements cost across the 50% threshold and triggers the rule. |

| Buildings in the SFHA must be anchored to resist floatation. |

Flood Insurance

| Flood Insurance Requirements for Buildings in the SFHA | Notes on Flood Insurance Requirements |

| Federal regulations require lenders to ensure that a flood insurance policy is in place to protect any building in the SFHA that is used to secure a loan in which the Federal government has an interest (either in the loan or in the lending institution). | The requirement for flood insurance is not Federally mandated for buildings NOT in the SFHA. However, a lender may require such insurance as a condition of making a new loan. |

| If the borrower does not obtain flood insurance for the building in the SFHA, the lender may force-place the insurance policy and pass the cost to the borrower. |

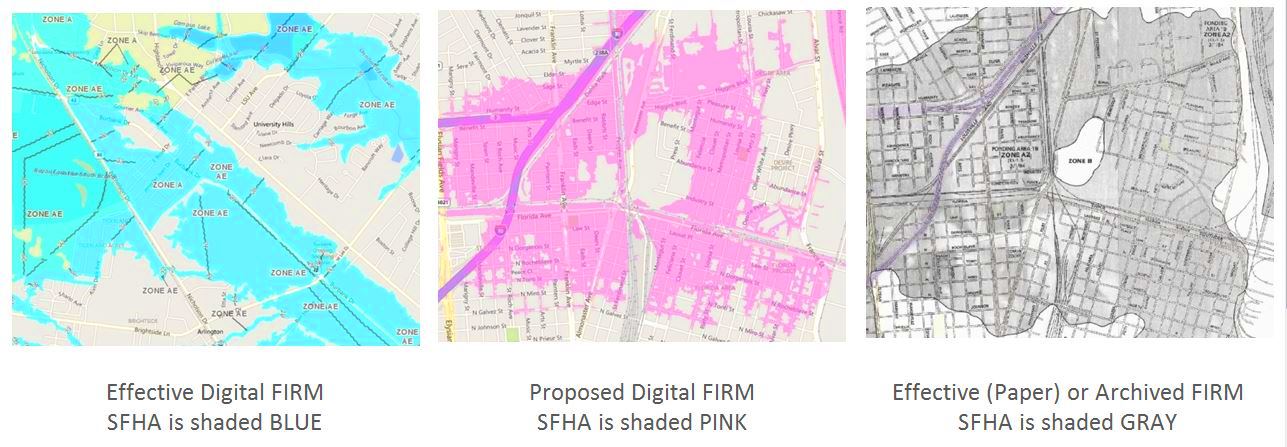

The lender is not allowed to force-place flood

insurance for buildings NOT in the SFHA on the Effective FIRM. The lender is not allowed to force-place flood insurance for buildings that are shown as being in the SFHA on a Preliminary or Future FIRM if they are not in the SFHA on the Effective FIRM. |